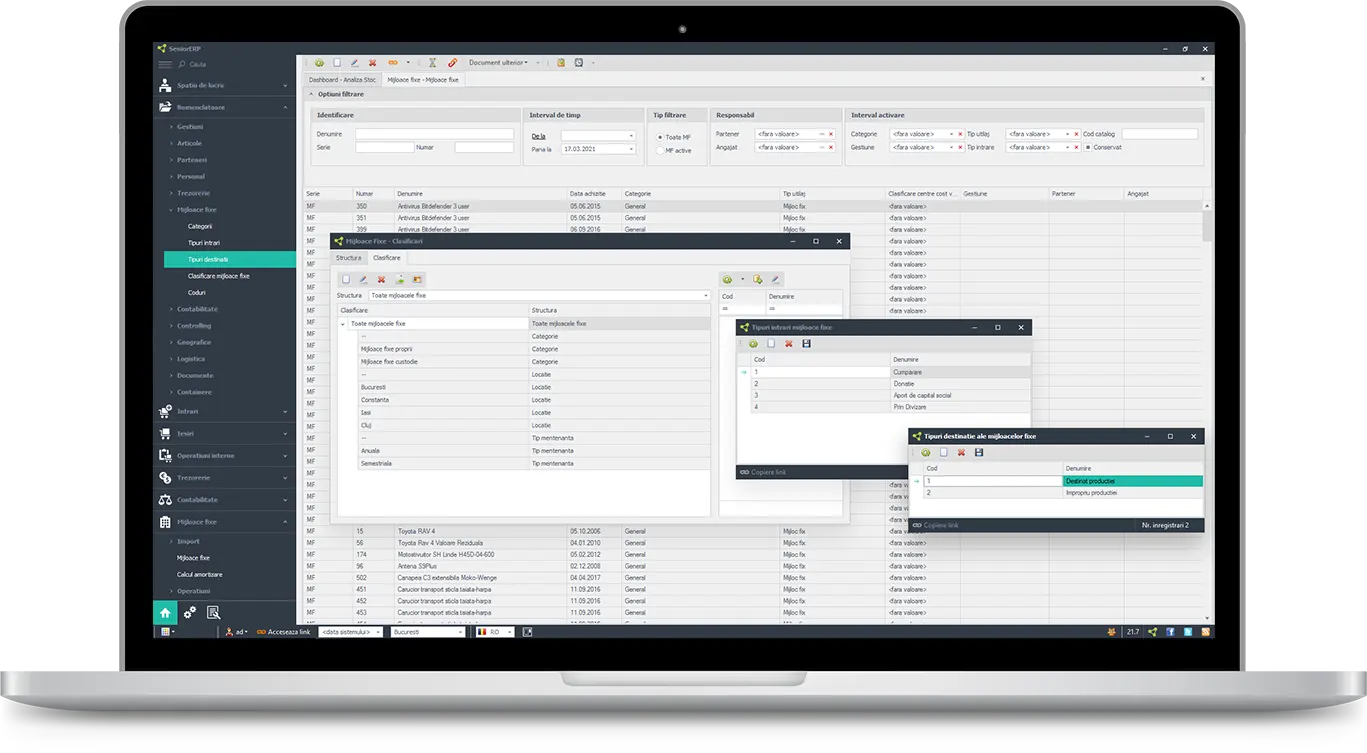

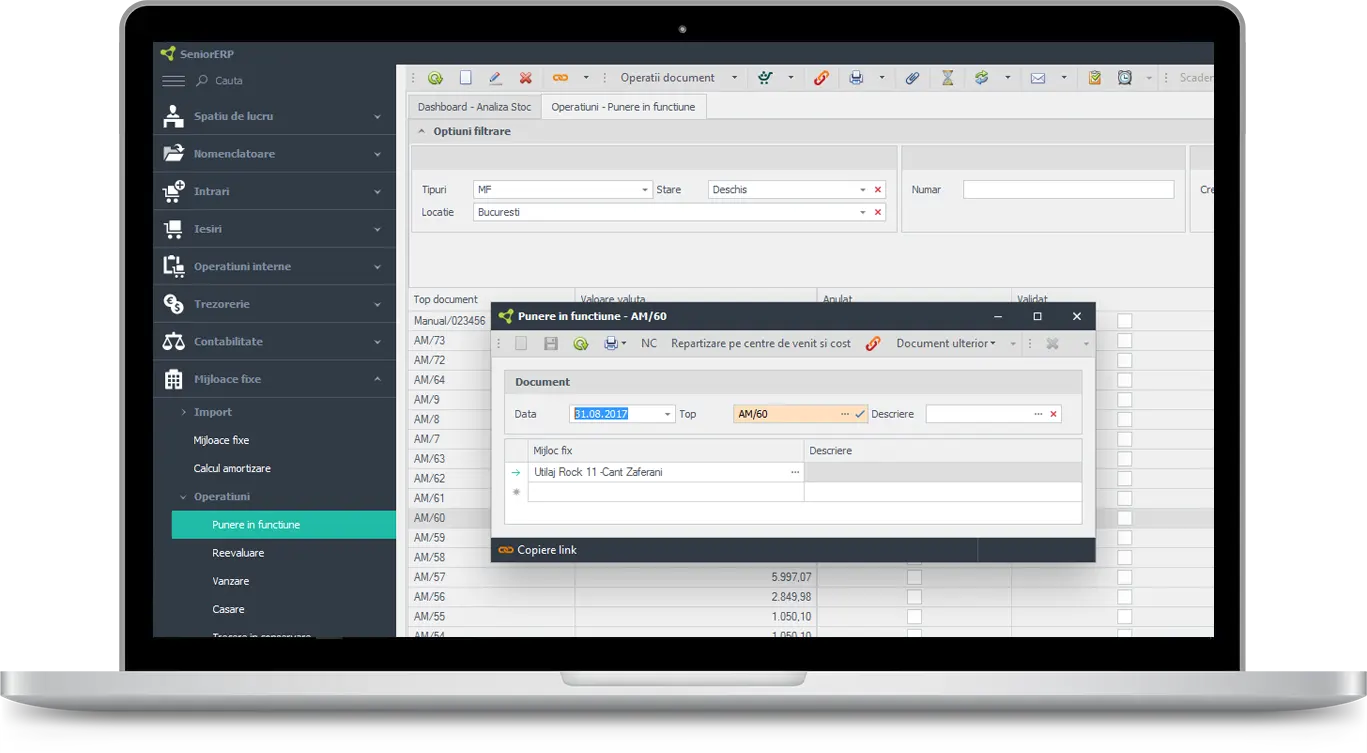

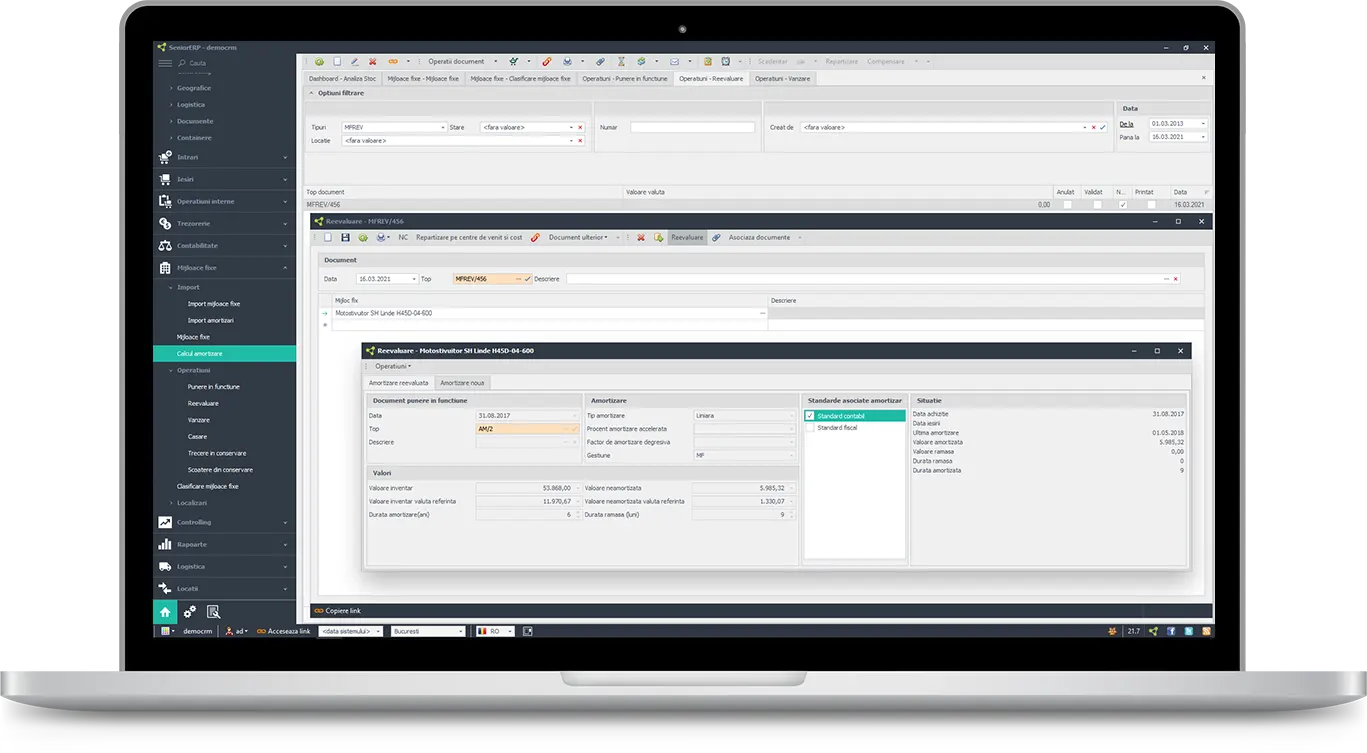

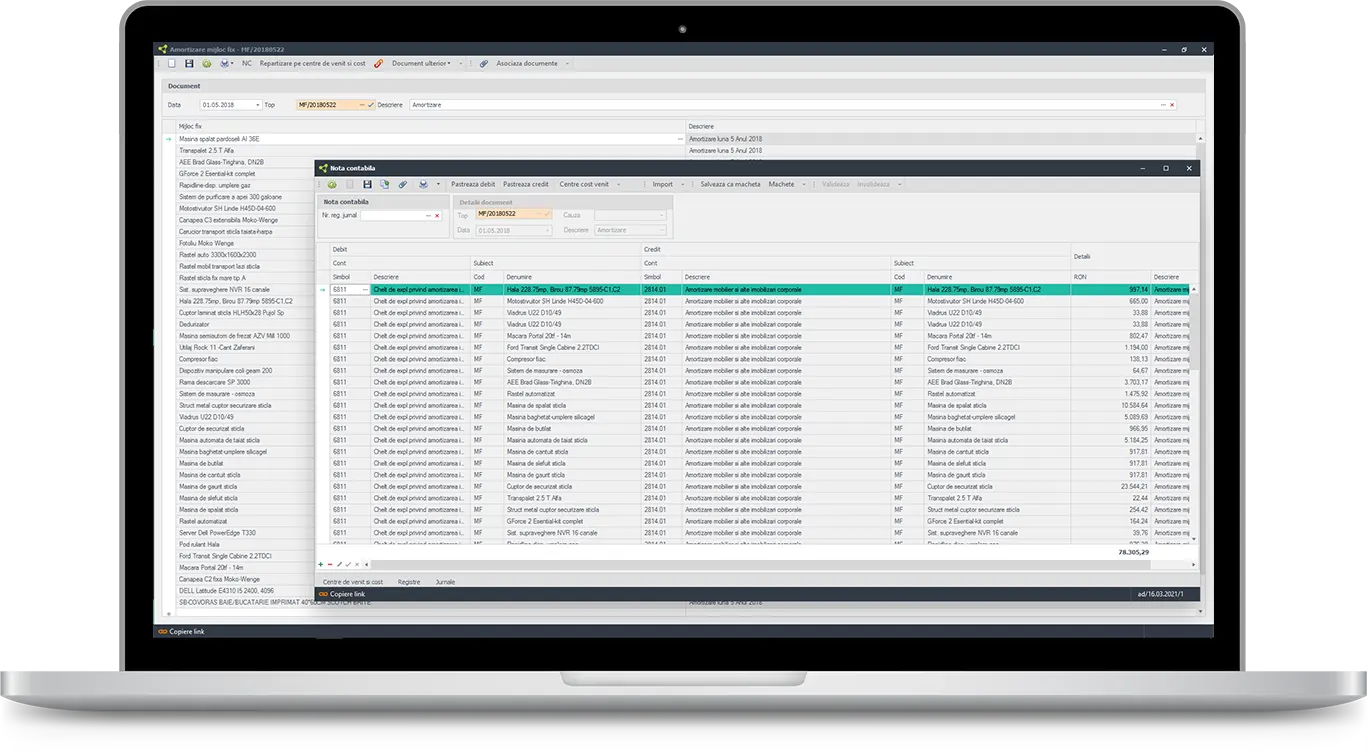

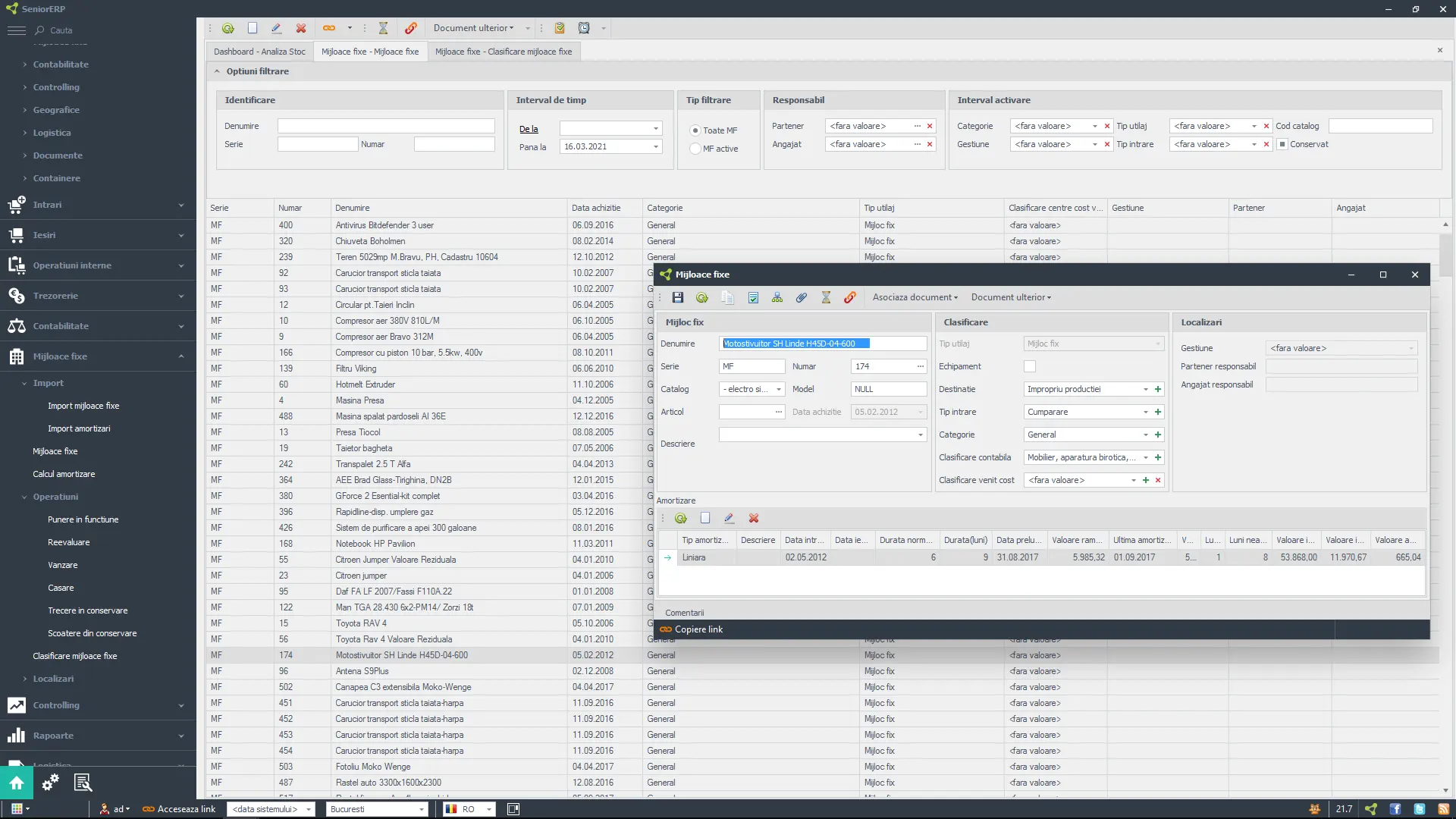

Fixed Assets ERP: Fixed Assets Catalogue

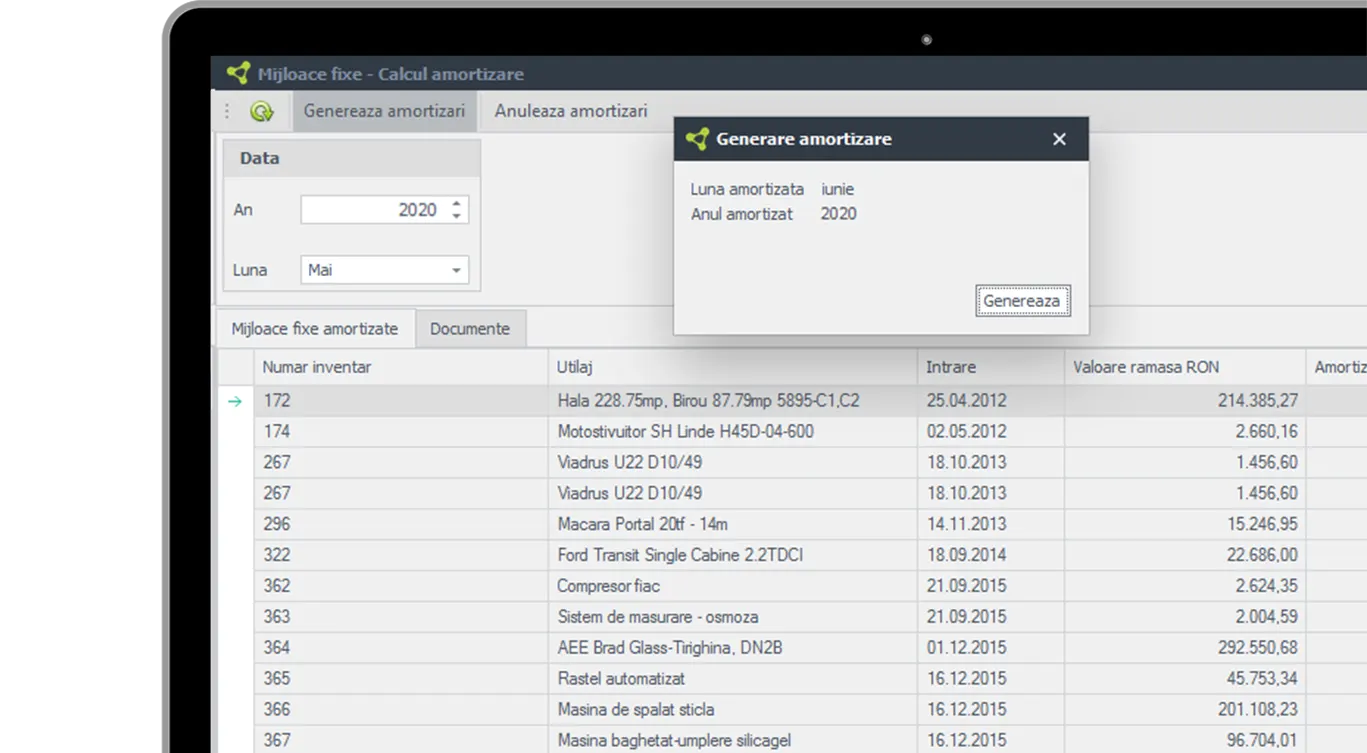

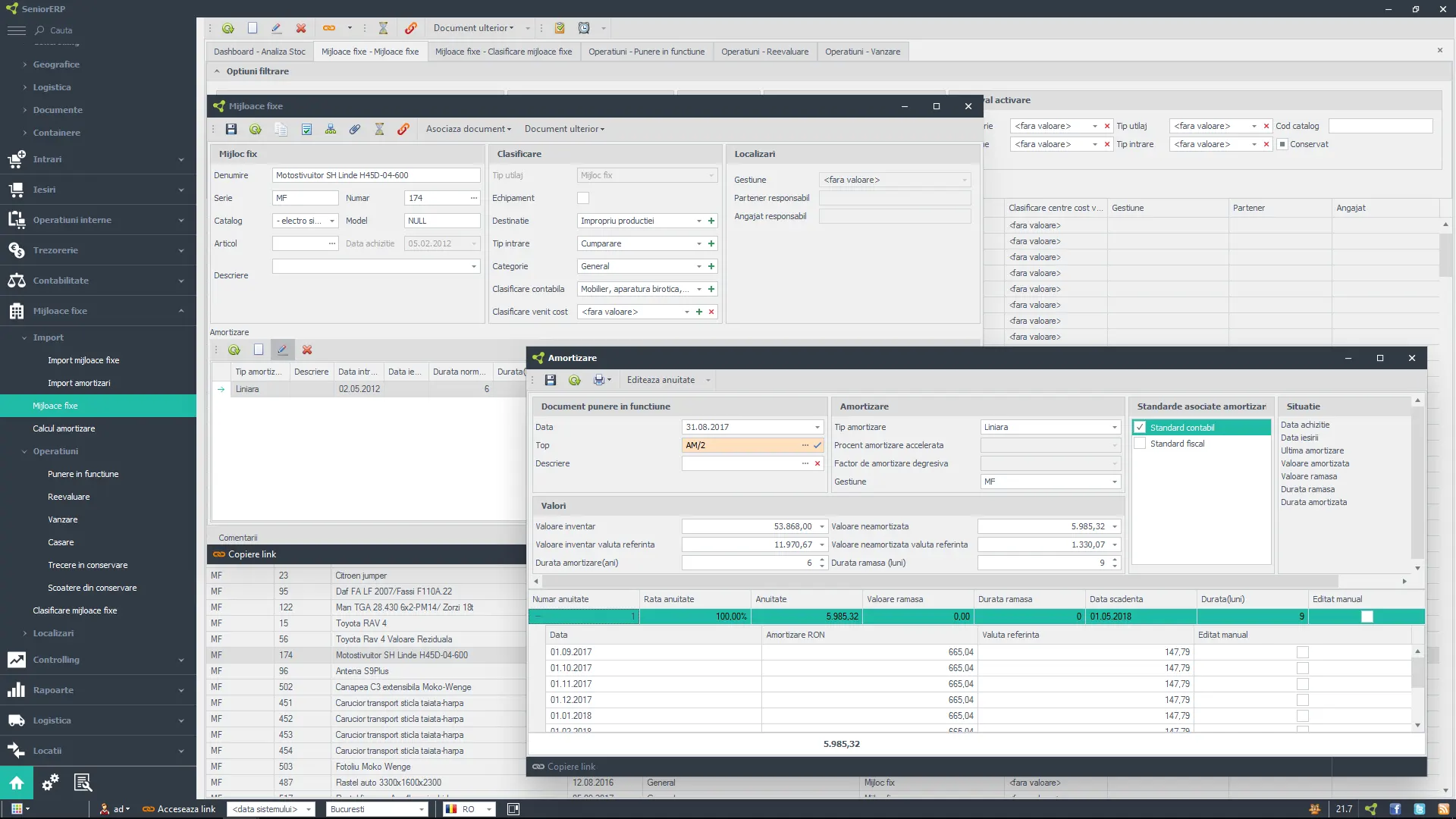

Represents all the company’s goods that are classified as fixed assets, or if it’s the case, small inventory. SeniorERP gives users access to catalogue with classification codes for fixed assets and allows you ot generate reports on fixed assets, all data coming from a single database.

Fixed assets can be added manually and through the elements of an invoice taken from the system and the catalogue which contains all classification codes for fixed assets can be edited at any time.

Romanian

Romanian English

English